- Details

- By Berge Ayvazian, Senior Consultant, Wireless 20/20

- Blog

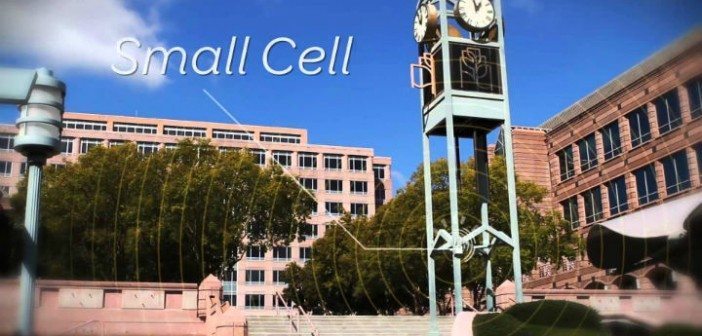

At CTIA Super Mobility 2016, the entire expo floor was transformed into a fully connected smart city with the entire wireless ecosystem assembled under one roof. On the Thursday keynote stage, Verizon Communications’ John Stratton and New Cities Foundation Founder and Chairman John Rossant explained what needs to happen to make smart cities a reality.